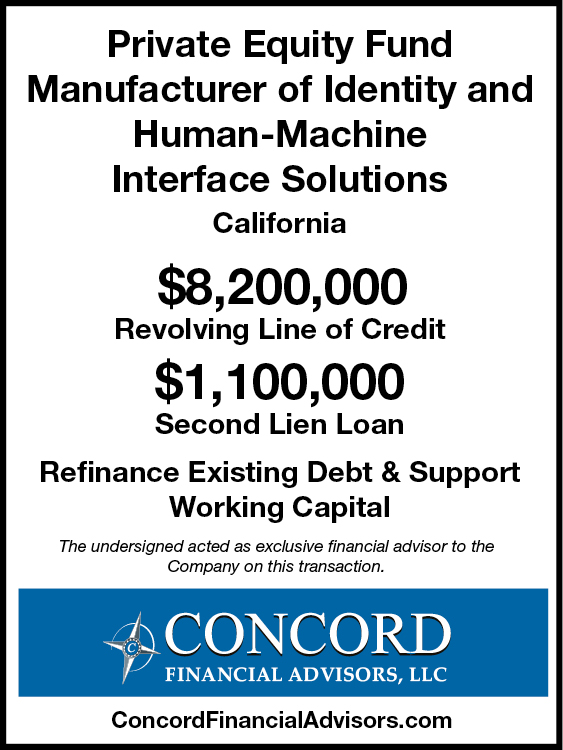

The Company was recovering rapidly from events which had negatively impacted profitability, and needed to find new lenders to support the continued improvement. The private equity fund owner was familiar with the debt markets and had multiple existing relationships, but it recognized the value of having an outsourced debt placement agent and engaged Concord to run the process.

Concord performed a situational analysis and prepared a detailed memorandum highlighting the successful ongoing turnaround, strong management and committed ownership. Concord was able to leverage its relationships with multiple nationally recognized, asset-based lenders and secure an aggressive structure for the company, including a $1.1MM second lien term loan with no covenants from one lender, coupled with an $8.2MM senior revolving line of credit from another lender. Concord closed the transaction within 6 weeks of going to market.