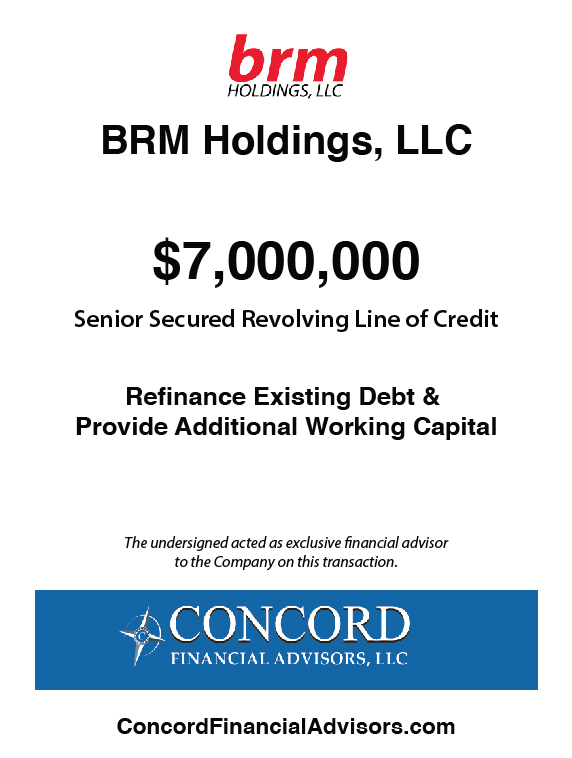

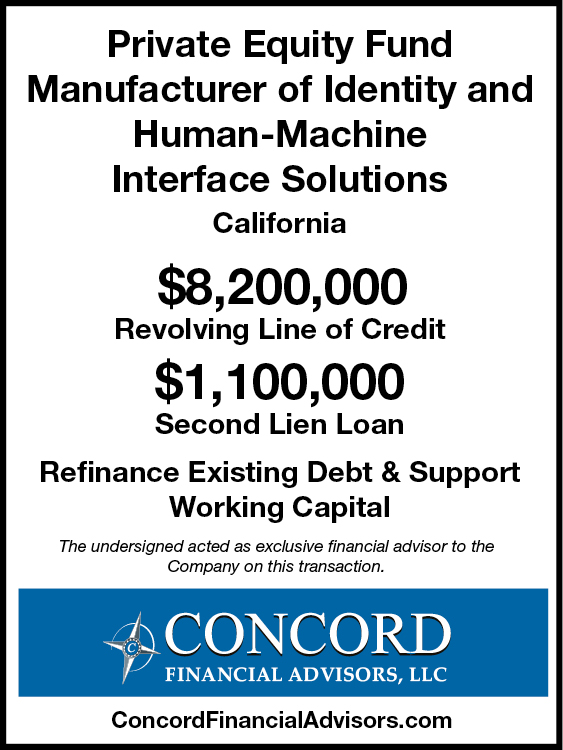

We were pleased to work with Tom Jones and his team at Concord. Our portfolio company needed to replace an existing senior lender, and Concord was there to help. Although we have many lender relationships, given the size of the financing needed, the complexity of our company’s capital structure, and operational challenges due to COVID-19, we didn’t have the right connections to get a financing done. Concord tapped into its substantial rolodex of lenders across the spectrum of Banks and Fincos to create a short list of attractive lenders for our needs. Because Concord knows the lender universe so well, they were able to counsel us on how best to position the company and structure our financing to give us the best chance of success in a very tough credit market. In the end, Concord was able to negotiate a deal on our behalf that allowed our company the liquidity and capital we needed to grow. I highly recommend Concord for debt placement services.