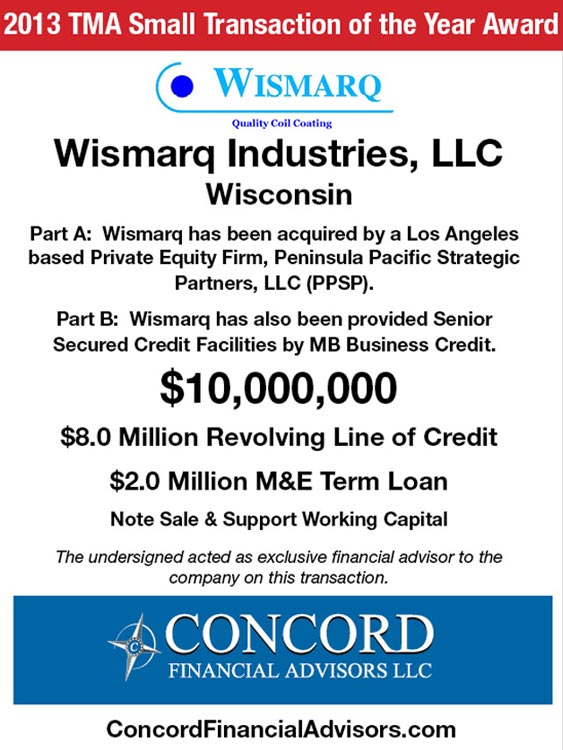

Headquartered in Wisconsin and with operations in Illinois, Pennsylvania and Tennessee, Wismarq Industries, LLC performs specialty coating of steel and aluminum for customers throughout the eastern United States, serving the commercial building and housing markets. The Company’s Lender declared a default and the parties entered into a forbearance agreement. It was concluded that the sale of Wismarq as a going concern or a refinance (if possible) was a better option than winding down the Company. Concord led the preparation of financial due diligence for potential lenders and/or investors by way of a secure data room. Concord Financial Advisors, LLC immediately assessed the situation and ran a very quick and intense, yet comprehensive, two-week process to find refinancing lenders and/or buyers. The most favorable proposal was made by a Los Angeles based private equity firm, Peninsula Pacific Strategic Partners, LLC (PPSP) which proposed to purchase the notes from the Lender. Peninsula proved to be a value-added equity partner providing a permanent solution. Concord also introduced PPSP to MB Business Credit, which moved quickly and aggressively to put together a working capital facility to augment the proposed note purchase. Working together and with the Lender, the team closed the transaction in less than

six weeks. As a result of the team’s efforts, a fundamentally sound but distressed company was restructured in a very short time frame with over 200 jobs retained.