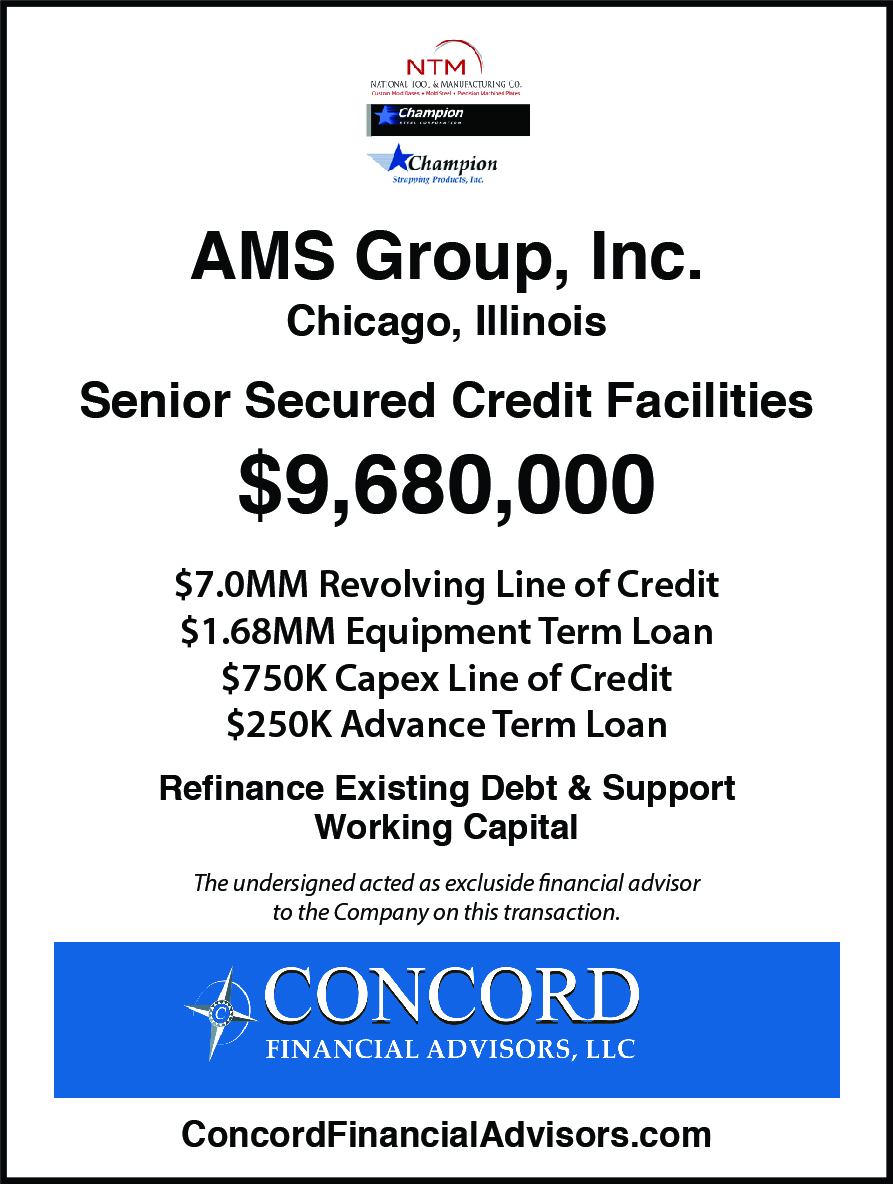

Concord Financial Advisors, LLC closed a $9.68MM Deal, including: $7.0MM Revolving Line of Credit, $1.68MM Equipment Term Loan, $750K CapEx Line of Credit, and $250K Advance Term Loan, for AMS Group, Inc. (“Company”).

AMS Group, Inc. is the parent company of three wholly owned subsidiary companies: National Tool & Manufacturing Co., Champion Steel Corporation, and Champion Strapping Products, Inc.

In early 2017, the Company’s bank determined that AMS was no longer a suitable fit for their portfolio and asked them to secure a new lender.

Initially AMS Group, Inc. searched for a new financing partner on its own. They met with multiple lenders, but received no attractive offers. The incumbent bank recommended that the Company utilize Concord’s debt placement services to secure a new lender.

Concord stepped in and ultimately saved AMS countless hours in their search for a new lender and significant fees from the incumbent bank . After completing our due diligence, we screened and qualified several lenders we knew to be appropriate for our client, at no cost. One consideration was that the Company wanted to work with a regional bank. Concord was able to leverage its relationship with a Chicago-based bank that was equipped to handle all of the loans requested and all of the cash management and treasury services for AMS. This bank liked the experience and expertise of the Company’s ownership / management team, and they were impressed by their customer base, core business model and recent improvements in performance.

Concord’s efficient and competitive process resulted in very favorable interest rates, deal structure and overall terms for our Client. The new financing through the bank provided AMS with the additional liquidity they needed for working capital and to finance growth.